The key to streamlining multi-site acquisition isn’t just speed—it’s weaponizing the process to build leverage and eliminate risk before the deal closes.

- Shift from passive checklists to proactive frameworks for due diligence, legal structuring, and risk mitigation.

- Use the Letter of Intent (LOI) and contingency periods as offensive tools to control deal velocity and outcomes.

Recommendation: Adopt a milestone-based contingency release system to replace ambiguous deadlines and force decisive action from all parties.

For an Expansion Manager juggling multiple property acquisitions, the process often feels like a defensive battle against delays, hidden costs, and shifting goalposts. The standard advice—”do your due diligence,” “build a good team”—is correct but incomplete. It frames acquisition as a linear checklist to be completed, a process that happens *to* you. This passive stance is where operational drag originates, deals stagnate, and leverage is lost. While financial analysis and site selection are crucial, they are only part of the equation.

The real bottleneck isn’t the tasks themselves, but the lack of a systematic playbook to execute them at scale and under pressure. This leads to budget overruns, prolonged negotiations, and valuable opportunities lost to more agile competitors. But what if the process itself could be transformed from a defensive shield into an offensive weapon? What if every step, from the initial budget to the final construction, was designed not just to vet a property but to actively build leverage and ensure rapid, repeatable success?

This is the core principle of a modern acquisition strategy: mastering the *mechanics* of the deal. This guide moves beyond the basics to provide a systematic framework for corporate expansion managers. We will dissect the critical leverage points in the acquisition timeline, revealing how to compress due diligence, structure deals for maximum protection and agility, and turn common pitfalls into strategic advantages. It’s time to stop managing acquisitions and start commanding them.

To navigate this complex process efficiently, this article breaks down the key strategic pillars of a streamlined acquisition playbook. The following sections provide actionable frameworks for every stage, from initial budgeting to post-acquisition risk management.

Summary: A Systematic Guide to Corporate Property Acquisition

- Why Your Acquisition Budget Is Likely 15% Too Low Before You Even Close?

- How to Perform Technical Due Diligence on Commercial Assets in Under 2 Weeks?

- SPV vs. Direct Ownership: Which Structure Protects the Parent Company Best?

- The Letter of Intent Mistake That Gives Sellers Too Much Leverage

- When to Buy in a Cooling Market: 3 Indicators of a Bottoming Cycle?

- Why Granting Long Contingency Periods Is the #1 Reason Deals Fail?

- How to Structure Leases to Enhance the Immediate Resale Value of Commercial Properties?

- How to Mitigate Construction Risks in Large-Scale Real Estate Developments?

Why Your Acquisition Budget Is Likely 15% Too Low Before You Even Close?

The most common budgeting error in corporate real estate is focusing solely on the purchase price. A truly accurate Total Cost of Acquisition (TCA) model must account for a host of “soft” costs that emerge during the transaction. These expenses, often underestimated or ignored in preliminary models, can easily inflate the final capital outlay by 15% or more. The reality is that commercial property acquisitions are a lengthy process, and every day spent in diligence or negotiation accrues costs.

A comprehensive budget anticipates these expenditures from day one, transforming them from unpredictable surprises into manageable line items. This involves a systematic accounting of all third-party services required to get the deal across the finish line. For expansion managers handling multiple sites, failing to standardize this detailed budgeting process creates significant financial risk and operational friction across the portfolio.

To build a resilient budget, you must meticulously factor in every potential expense. This includes not just the obvious legal fees but the entire ecosystem of due diligence consulting. A robust TCA model will always include provisions for building condition reports from engineers, Phase I environmental assessments, professional valuation appraisals, and detailed land surveys. Furthermore, state-specific costs like title insurance premiums and transfer taxes, along with their customary allocations between buyer and seller, must be calculated upfront, not as an afterthought.

How to Perform Technical Due Diligence on Commercial Assets in Under 2 Weeks?

The traditional 30-to-60-day due diligence period is a primary source of operational delay. For multi-site expansion, this timeline is untenable. The solution is not to cut corners but to weaponize the process through a parallel, technology-driven workflow. Compressing technical due diligence into a two-week sprint requires front-loading consultant engagement and leveraging digital tools for rapid analysis.

This accelerated model involves deploying a pre-vetted team of specialists—structural engineers, HVAC technicians, and environmental analysts—the moment the LOI is signed. Instead of a sequential review, all physical inspections happen concurrently. This requires precise coordination and a standardized reporting framework. As demonstrated by the deep-dive approach of firms like Brian Properties, a thorough evaluation of physical conditions, from roofs and foundations to potential asbestos, can be executed swiftly when planned as a coordinated effort.

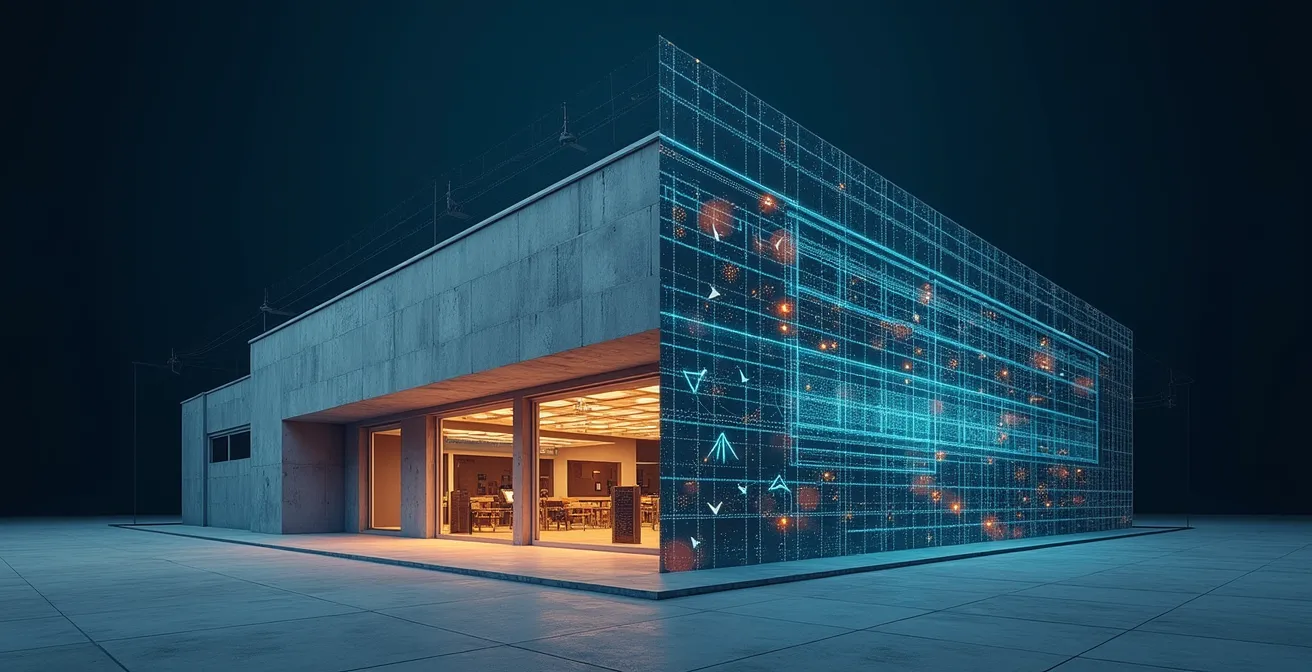

This paragraph introduces the concept of rapid, tech-enabled due diligence. To truly grasp the power of this approach, it helps to visualize how physical assets are translated into actionable data. The illustration below represents this fusion of the physical and digital, where a building is scanned and analyzed to create a “digital twin” for immediate evaluation.

As this visualization suggests, the goal is to transform physical inspections into a dynamic data model. This allows the acquisition team to identify major capital expenditure requirements, review existing warranties, and understand future maintenance liabilities in days, not weeks. This systematic foresight is the key to maintaining deal velocity without sacrificing thoroughness.

SPV vs. Direct Ownership: Which Structure Protects the Parent Company Best?

One of the most critical strategic decisions in a multi-site expansion is the ownership structure for new assets. The choice between acquiring a property directly under the parent company’s name or creating a Special Purpose Vehicle (SPV) for each acquisition has profound implications for liability, financing, and future portfolio agility. While direct ownership offers administrative simplicity, it directly exposes the parent company’s entire balance sheet to any liabilities associated with the new property.

In contrast, an SPV—a separate legal entity created solely to own the asset—acts as a structural shield. It quarantines the risks of that specific property, protecting the parent company from lawsuits, loan defaults, or other financial issues tied to that site. For corporations managing a diverse and growing portfolio, this liability isolation is a non-negotiable element of risk management. While setting up multiple SPVs increases the administrative burden, the protection and flexibility it affords often far outweigh the costs.

The following table, based on principles of M&A structuring, breaks down the key differences to guide your decision-making. As outlined in analyses of acquisition methods, the chosen entity structure dictates operational and financial outcomes.

| Factor | Special Purpose Vehicle (SPV) | Direct Ownership |

|---|---|---|

| Liability Protection | Strong isolation from parent company | Direct exposure to parent balance sheet |

| Portfolio Agility | Individual assets easier to sell | Simpler consolidated management |

| Operational Funding | Complex debt management across SPVs | Streamlined funding processes |

| Administrative Burden | Higher – multiple entities to manage | Lower – single entity structure |

| Exit Flexibility | Can sell individual SPVs without disrupting operations | More complex portfolio disposition |

Ultimately, for a dynamic expansion strategy, the SPV model provides superior exit flexibility. Selling an individual property becomes a simple transaction of selling the SPV entity, without the complexities of carving out an asset from the parent company’s books. This agility is a key advantage in optimizing a large-scale real estate portfolio.

The Letter of Intent Mistake That Gives Sellers Too Much Leverage

The Letter of Intent (LOI) is the single most important leverage point in the early stages of an acquisition. A common mistake is to treat it as a generic, non-binding handshake agreement focused only on price and closing date. A strategic LOI, however, is a detailed roadmap that dictates the terms of engagement for the entire due diligence period. A weak LOI cedes control to the seller, creating ambiguity that leads to delays and eroded negotiating power.

To weaponize the LOI, it must be highly specific about the buyer’s rights and the seller’s obligations. This is where you secure the upper hand. For example, a powerful LOI doesn’t just ask for a due diligence period; it demands pre-closing access rights for IT and operations teams to begin integration planning. It doesn’t just mention a closing date; it includes clear seller performance covenants with specific timelines for document delivery. Attaching a detailed due diligence checklist as an appendix to the LOI removes any ambiguity about the scope of your investigation.

As demonstrated in strategic portfolio management by firms like Hokanson Companies, this level of detail in initial agreements is instrumental for corporations managing large-scale acquisitions. By defining the rules of the game upfront, you prevent the seller from withholding information or slow-walking the process. The LOI should also specify conditions that allow for penalty-free termination by the buyer, protecting your deposit and resources if critical issues are uncovered. This transforms the LOI from a simple letter into a powerful control mechanism.

When to Buy in a Cooling Market: 3 Indicators of a Bottoming Cycle?

Timing the market is notoriously difficult, and waiting for the absolute “bottom” is a fool’s errand that often results in missed opportunities. For strategic acquirers, the goal isn’t to perfectly time the trough but to identify leading indicators that signal a stabilization phase—the optimal entry point before competition heats up again. In a cooling market, three key micro-market indicators provide more reliable signals than broad national trends.

First, monitor the stabilization of absorption rates. When the rate at which available commercial space is leased or sold stops declining and holds steady for a quarter, it signals that demand has found a floor. Second, track local labor pool availability and cost. A halt in rising unemployment or even a slight uptick in hiring in the target region indicates that businesses are regaining confidence, which precedes a recovery in real estate demand. Third, watch for an increase in zoning and permit applications. This is a forward-looking indicator that developers and other businesses are preparing for future growth, often months before it appears in transaction data.

This data-driven approach is a core part of modern portfolio management, a market whose importance is growing. In fact, one projection highlights the growing importance of strategic timing in acquisitions as the sector expands. Success requires shifting focus from lagging price indicators to these leading operational metrics.

As detailed in advanced site selection strategies, these micro-market indicators are critical. The most successful acquirers create proprietary “Acquisition Opportunity Scores” based on these data points, allowing them to act with confidence while others remain paralyzed by uncertainty.

Why Granting Long Contingency Periods Is the #1 Reason Deals Fail?

Long, unstructured contingency periods are the enemy of deal velocity. A blanket 60-day period for “due diligence and financing” creates a vacuum where momentum dies, minor issues become major roadblocks, and stakeholders get cold feet. It invites procrastination and allows competing offers to surface. The most effective way to streamline acquisitions is to eliminate these open-ended timelines and replace them with a structured, milestone-based framework.

This approach forces focus and maintains pressure on all parties to perform. Instead of a single deadline, you create a series of rolling releases tied to specific tasks. For example, the financing contingency is separated from the physical inspection contingency, each with its own short deadline. This compartmentalizes the process and provides clear go/no-go decision points throughout the transaction. This philosophy is rooted in a simple but powerful truth about high-stakes negotiations.

Speed forces focus and commitment. Long, unstructured periods create a vacuum where minor issues escalate and stakeholders get cold feet.

– Commercial Real Estate Advisory, Deal Momentum Theory in Property Acquisitions

Implementing this requires a shift in how you structure the purchase agreement. It’s about creating a system of accountability with clear deadlines and consequences. This is not about rushing the process; it’s about managing it with precision to ensure that every day serves a purpose.

Your Action Plan: The Structured Contingency Release Framework

- Replace blanket 60-day contingencies with a detailed schedule of milestones and deadlines.

- Structure rolling releases for financing (Weeks 2-3) separately from physical inspections (Weeks 1-2) and legal review (Weeks 3-4).

- Set specific deadlines for the seller’s performance benchmarks, such as document delivery.

- Include acceleration clauses that allow for a faster closing if all conditions are met early.

- Build in penalty provisions for missed milestone deadlines by either party to maintain accountability.

How to Structure Leases to Enhance the Immediate Resale Value of Commercial Properties?

For a corporate acquirer, the value of a commercial property isn’t just in its current use, but in its future liquidity and resale potential. Structuring leases with an eye toward the next buyer is a powerful value-add strategy. Standard, rigid NNN (triple net) leases offer stability but limited upside, appealing primarily to conservative, passive investors. To attract strategic corporate buyers and command a premium, leases must be built for flexibility and future growth.

The key is to implement Operational Flex Leases. These agreements contain pre-negotiated expansion and contraction clauses, allowing tenants to scale their space up or down based on business needs. This feature is highly attractive to dynamic companies and can justify higher rents. Another powerful tool is incorporating Smart Building Clauses, which commit to technology and ESG (Environmental, Social, and Governance) upgrades, future-proofing the asset and appealing to a growing class of institutional investors.

As value-add strategies from firms like Brian Properties have shown, customizing improvements and enhancing common areas for tenants can transition a property from below-market to premium positioning. The impact of these lease structures on valuation is significant and directly influences the type of buyer you will attract upon exit.

The following table illustrates how different lease types affect a property’s value and appeal to different buyer profiles, with data showing a potential 15-20% value premium for properties with flexible lease structures.

| Lease Type | Impact on Value | Buyer Appeal |

|---|---|---|

| Traditional NNN | Stable but limited upside | Conservative investors |

| Operational Flex Leases | 15-20% value premium | Strategic corporate buyers |

| Smart Building Clauses | Future-proof appreciation | ESG-focused investors |

| Staggered Purchase Options | Enhanced exit flexibility | Value-add specialists |

By thinking like a future seller from day one, you embed value directly into the asset’s legal and operational framework, ensuring a more profitable and liquid investment.

Key Takeaways

- Streamlining acquisition is about proactive process control, not just speed. Turn defensive steps like due diligence into offensive tools for leverage.

- Hidden “soft costs” can inflate budgets by over 15%. A Total Cost of Acquisition (TCA) model must include all consulting, legal, and tax liabilities upfront.

- Replace long, open-ended contingency periods with a milestone-driven framework to maintain deal velocity and force accountability.

How to Mitigate Construction Risks in Large-Scale Real Estate Developments?

For acquisitions that involve new construction or significant redevelopment, the project’s success hinges on mitigating construction risk before a single shovel hits the ground. Supply chain disruptions, labor shortages, and unexpected site conditions can derail timelines and budgets. A proactive risk mitigation framework is essential for protecting the investment.

The first step is to engage general contractors early through Pre-Construction Services Agreements (PCSAs). This brings their practical expertise into the final design phase, allowing for value engineering and realistic cost estimates before the budget is locked. A critical component of this early phase is building a Global Supply Chain Risk Matrix. This involves identifying all long-lead items, such as specialized HVAC units or curtain wall systems, and pre-ordering them to avoid delays. For each critical material, a contingency plan must be in place.

Furthermore, on-site environmental risks cannot be overlooked. As land acquisition specialists emphasize, any problems revealed during site due diligence become the owner’s responsibility. Therefore, conducting thorough Phase I and often Phase II environmental assessments is a non-negotiable part of the pre-construction process. Finally, for risks that cannot be controlled, such as weather, securing parametric insurance with automatic triggers for events like excessive rainfall provides a financial backstop without lengthy claims processes. This systematic de-risking is fundamental to delivering large-scale projects on time and on budget.

By integrating these systematic frameworks for budgeting, due diligence, legal structuring, and risk mitigation, you transform your acquisition process from a series of reactive steps into a repeatable, high-performance engine for corporate growth. The next logical step is to codify this playbook and deploy it consistently across your entire portfolio to ensure scalable success.